Forex Trading

The foreign exchange market, commonly known as the forex market, is the largest and most liquid financial market in the world. It serves as a global decentralized platform where currencies are traded. Unlike traditional stock markets that have a centralized exchange, the forex market operates 24 hours a day, five days a week, across major financial centers in different time zones.

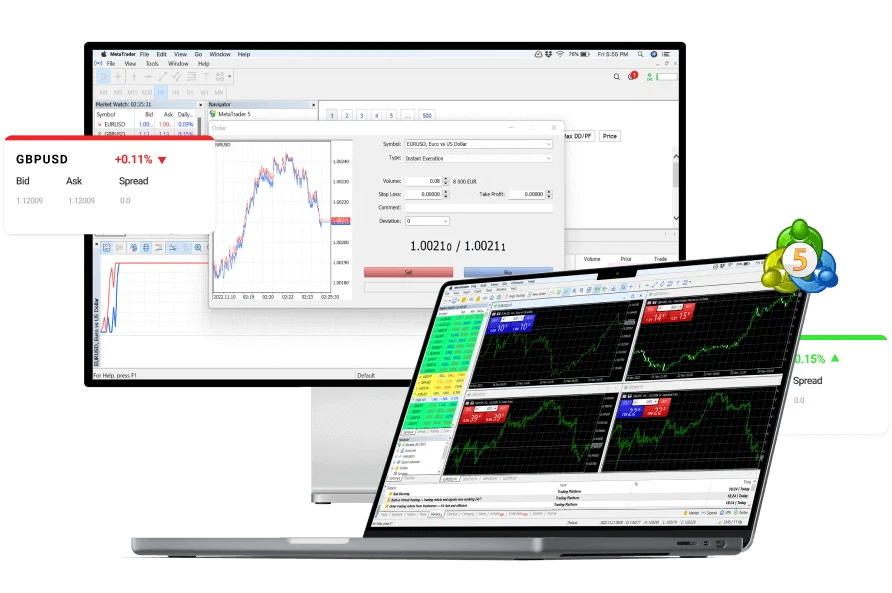

Follow professional traders and mirror their trades through Trading Platform.

Omega Finex is regulated and registered in two jurisdictions across the globe to ensure safety.

We provide more than 800 tradable assets on Omega Finex with best trading conditions.

This continuous operation allows participants to engage in currency trading at any time, making it one of the most accessible markets for investors.

What is the purpose of Forex Trading?

The primary purpose of the forex market is to facilitate the exchange of one currency for another, enabling international trade and investment. Participants in the forex market include banks, financial institutions, corporations, governments, and individual traders. These entities engage in currency trading for various reasons, such as conducting international business transactions, managing currency exposure, or seeking speculative opportunities to profit from fluctuations in exchange rates.

The forex market operates on the principle of currency pairs, where one currency is exchanged for another at an agreed-upon exchange rate. Major currency pairs include the US Dollar (USD) against the Euro (EUR), Japanese Yen (JPY), British Pound (GBP), and others. Exchange rates are influenced by a myriad of factors, including economic indicators, geopolitical events, interest rates, and market sentiment. Central banks, through monetary policy, also play a significant role in shaping exchange rates.

How to trade Forex?

Forex trading can be conducted through various means, including spot transactions, futures contracts, options, and other derivatives. The advent of electronic trading platforms has further increased the accessibility and efficiency of forex trading. While the forex market offers opportunities for profit, it also comes with risks, given the volatility and complexity associated with currency movements. Traders and investors need to carefully analyze market conditions and employ risk management strategies to navigate the dynamic nature of the forex market.

Engaging in forex trading offers the advantage of heightened liquidity, with the market boasting an impressive daily trading volume of $4 trillion. This substantial liquidity facilitates seamless entry and exit from trades, ensuring that participants can execute transactions with ease and efficiency, regardless of the time.

Forex trading provides an unparalleled level of flexibility by offering a diverse range of options suitable for various budgetary constraints. Traders can explore an extensive selection of currency pairs

The forex market stands out for its 24-hour availability, allowing traders to participate in the action every business day, regardless of their geographical location. This constant market activity ensures that opportunities are not confined to specific time zones, providing traders with the convenience of executing trades at any hour.

Forex trading presents the unique advantage of profit potential in both upward and downward market trends.

Forex Trading Essentials

Once you’ve established an account with a broker, deposit the desired trading funds into your account. The broker will provide you with a unique username and password, granting access to the trading software or platform. Armed with these credentials, you gain the ability to execute buy or sell orders, complete trades, and engage in various trading activities seamlessly.

Diversifying Your Forex Portfolio

In recent times, the scope of Forex trading has broadened beyond conventional currency pairs. Now, traders can delve into a diverse array of assets, including precious metals, digital currencies, stocks, oil, and various other investment instruments. This expansion, driven by technological advancements, empowers traders to diversify their portfolios, strategically mixing investments to better manage risk and capitalize on market opportunities. Stay ahead in the dynamic world of Forex by exploring these expanded trading options.