Cyrptocurrency Trading

Stock trading is the process of buying and selling shares of publicly traded companies on stock exchanges. It provides individuals and institutional investors with the opportunity to participate in the financial markets and potentially profit from changes in a company's stock price.

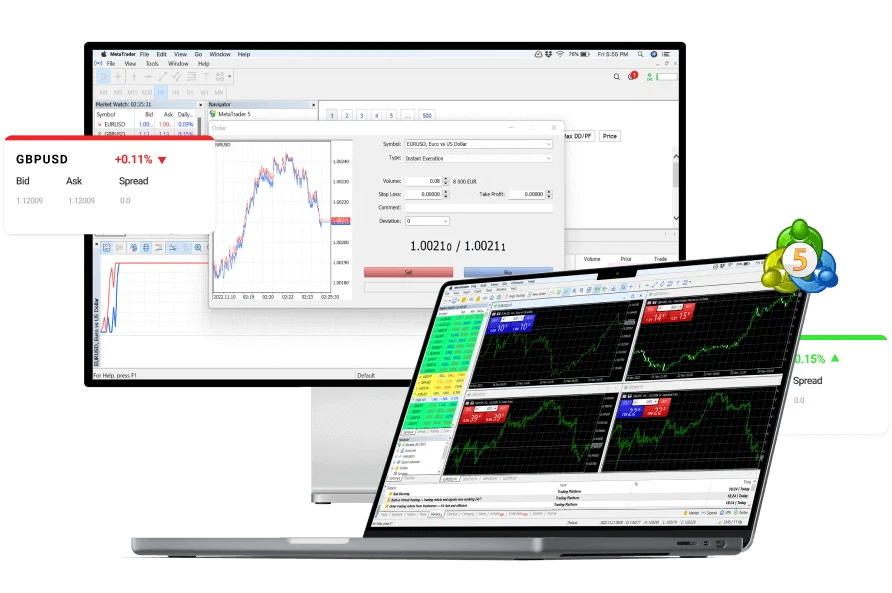

Follow professional traders and mirror their trades through Trading Platform.

Omega Finex is regulated and registered in two jurisdictions across the globe to ensure safety.

We provide more than 800 tradable assets on Omega Finex with best trading conditions.

Cryptocurrency trading involves buying, selling, and exchanging digital currencies, also known as cryptocurrencies, with the aim of making a profit. Cryptocurrencies are decentralized digital assets that utilize cryptography for secure transactions and operate on blockchain technology. Here’s an overview of cryptocurrency trading:

Digital Currencies: Cryptocurrencies are digital or virtual currencies that use cryptography for security and operate independently of central banks or governments. Bitcoin (BTC) was the first cryptocurrency, introduced in 2009, and since then, thousands of alternative cryptocurrencies, often referred to as altcoins, have been created.

Trading Platforms: Cryptocurrency trading can take place on various online platforms, known as cryptocurrency exchanges. These exchanges facilitate the buying, selling, and trading of cryptocurrencies against fiat currencies (such as USD, EUR) or other cryptocurrencies. Examples of popular cryptocurrency exchanges include Binance, Coinbase, Kraken, and Bitfinex.

Volatility: Cryptocurrency markets are known for their high volatility, meaning that prices can fluctuate dramatically in a short period. While this volatility presents opportunities for profit, it also carries significant risks.

Trading Strategies: Cryptocurrency trading involves various strategies, including day trading, swing trading, and long-term investing. Day traders aim to profit from short-term price movements by executing multiple trades within a single day. Swing traders hold positions for a few days or weeks to capitalize on medium-term price fluctuations. Long-term investors buy and hold cryptocurrencies for an extended period, believing in their potential for long-term growth.

Risk Factors: Cryptocurrency trading carries inherent risks due to factors such as price volatility, market manipulation, regulatory uncertainty, security breaches, and technological risks. It’s essential for traders to conduct thorough research, manage risk effectively, and only invest what they can afford to lose.

Regulation: The regulatory environment for cryptocurrencies varies significantly across different countries and regions. Some jurisdictions have implemented regulations to govern cryptocurrency exchanges and trading activities, while others have adopted a more permissive approach or are still developing their regulatory frameworks.

Cryptocurrencies operate on decentralized networks, typically based on blockchain technology. This means that they are not controlled by any single authority, such as a government or central bank. Instead, transactions are verified and recorded on a distributed ledger maintained by a network of nodes.

Cryptocurrencies offer varying degrees of anonymity and privacy for users. While transactions are recorded on the blockchain and are publicly visible, the identities of the parties involved are typically pseudonymous, represented by cryptographic addresses rather than real-world identities.

Cryptocurrencies use cryptographic techniques to secure transactions and control the creation of new units. Each transaction is verified and recorded on the blockchain, making it immutable and tamper-proof. Additionally, users have control over their own cryptocurrency holdings through private keys, which are cryptographic keys that enable access to their funds.

Cryptocurrency markets are known for their high volatility, with prices often experiencing rapid and substantial fluctuations within short periods. This volatility can present both opportunities and risks for traders, depending on their trading strategies and risk tolerance.

Trading in the cryptocurrency market may appeal to individuals for several reasons, including:

Potential for High Returns: The cryptocurrency market is known for its volatility, which can create opportunities for significant returns on investment in a relatively short period. Some traders have profited immensely from price movements in cryptocurrencies, especially during bull markets.

Diversification: Cryptocurrencies offer a new asset class for diversifying investment portfolios. Adding cryptocurrencies to a traditional portfolio of stocks, bonds, and commodities can help spread risk and potentially improve overall returns, as cryptocurrencies may not always move in correlation with traditional financial markets.

Accessibility: Cryptocurrency trading is accessible to anyone with an internet connection and a trading account on a cryptocurrency exchange. Unlike traditional financial markets, which may have high barriers to entry, such as minimum investment requirements or geographical restrictions, cryptocurrency trading platforms are often open to individuals worldwide, allowing participation from diverse backgrounds.

Innovation and Technological Potential: Many people are attracted to cryptocurrencies due to the underlying blockchain technology and the potential for innovation in various industries. Blockchain technology has applications beyond cryptocurrencies, including supply chain management, decentralized finance (DeFi), digital identity verification, and more. By participating in the cryptocurrency market, individuals can support and potentially benefit from ongoing technological advancements and disruption.

Decentralization and Financial Freedom: Cryptocurrencies operate on decentralized networks, which means they are not controlled by any single authority, such as a government or central bank. This decentralization ethos aligns with the principles of financial sovereignty and individual autonomy, allowing users to have greater control over their funds and financial transactions without relying on intermediaries.

However, it’s essential to recognize that trading in the cryptocurrency market also carries risks, including price volatility, regulatory uncertainty, security threats, and market manipulation. Individuals should conduct thorough research, understand the risks involved, and only invest what they can afford to lose. Additionally, trading in cryptocurrencies requires technical knowledge, risk management skills, and the ability to stay informed about market developments.