Indices Trading

Indices trading involves speculating on the price movements of stock market indices, which are measures of the performance of a group of stocks representing a particular sector, market, or economy. Instead of trading individual stocks, traders can buy or sell contracts based on the value of an index, allowing them to gain exposure to the broader market or specific sectors without directly owning the underlying assets.

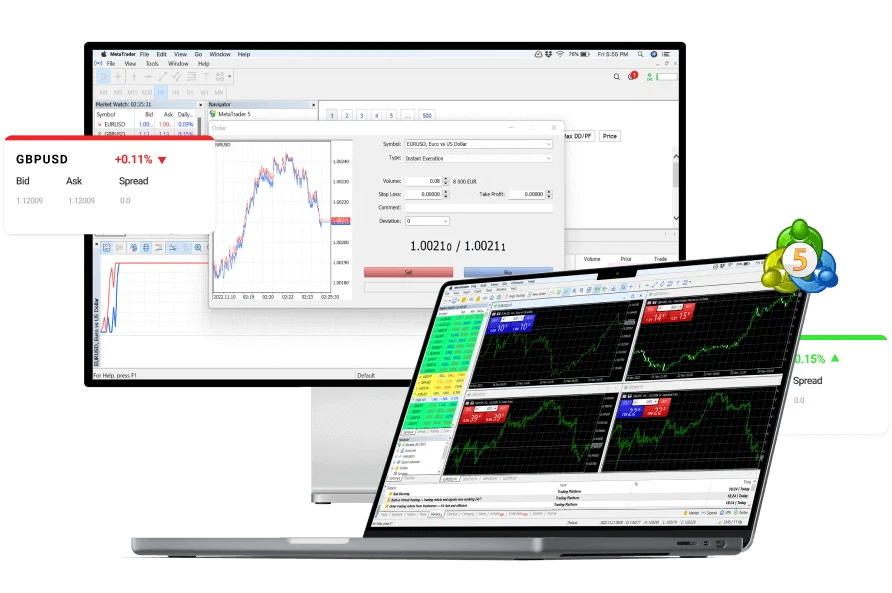

Follow professional traders and mirror their trades through Trading Platform.

Omega Finex is regulated and registered in two jurisdictions across the globe to ensure safety.

We provide more than 800 tradable assets on Omega Finex with best trading conditions.

How Does Indices Trading Work?

Here’s how indices trading typically works:

Selection of Indices: Traders can choose from a variety of stock market indices, each representing different segments of the market. Common indices include the S&P 500, Dow Jones Industrial Average (DJIA), NASDAQ Composite, FTSE 100, and DAX.

Speculation on Price Movements: Traders speculate on whether the value of a chosen index will rise or fall within a certain timeframe. They can go long (buy) if they anticipate the index will increase in value or go short (sell) if they expect it to decline.

Derivative Instruments: Indices trading is often conducted using derivative financial instruments such as index futures, index options, and contracts for difference (CFDs). These instruments allow traders to gain exposure to the underlying index’s price movements without owning the actual stocks that comprise the index.

Leverage: Many indices trading instruments offer leverage, allowing traders to control larger positions with a smaller amount of capital. While leverage can amplify profits, it also increases the potential for losses, and traders should use it cautiously.

Diversification: Indices trading provides traders with exposure to a diversified basket of stocks, reducing the risk associated with investing in individual companies. It allows traders to spread their investment across multiple sectors or markets, potentially mitigating the impact of adverse events affecting any single stock.

Market Analysis: Successful indices trading often involves conducting thorough market analysis, including technical analysis, fundamental analysis, and sentiment analysis. Traders may analyze historical price data, economic indicators, corporate earnings reports, and news events to make informed trading decisions.

Indices trading provides exposure to a diversified basket of stocks within a specific sector, market, or region. By trading indices, investors can spread their risk across multiple companies and industries, reducing the impact of adverse events affecting any single stock.

Many indices trading instruments, such as index futures and exchange-traded funds (ETFs), are highly liquid, meaning there is a high volume of trading activity and ample opportunities for buying and selling. High liquidity typically results in tighter bid-ask spreads and lower transaction costs for traders.

Indices trading allows investors to gain exposure to the overall performance of the stock market or specific sectors without having to invest in individual stocks. This broader market exposure enables investors to participate in the growth potential of the entire market.

Compared to trading individual stocks, indices trading often involves lower costs and fees. Trading indices through instruments such as ETFs or index funds typically incurs lower brokerage fees and management expenses than buying and selling multiple stocks individually.

Indices trading is popular among both retail and institutional traders as it offers opportunities to profit from the overall direction of the market or specific sectors.

However, like any form of trading, it carries risks, including market volatility, leverage-related risks, and the potential for losses. Traders should develop a robust trading strategy, manage risk effectively, and stay informed about market developments to succeed in indices trading.