Commodities Trading

Commodities trading in the context of the forex market generally refers to the trading of commodity-based currency pairs. In the forex market, currencies are traded in pairs, and each pair represents the exchange rate between two currencies. Some of these currency pairs are influenced by the prices of commodities.

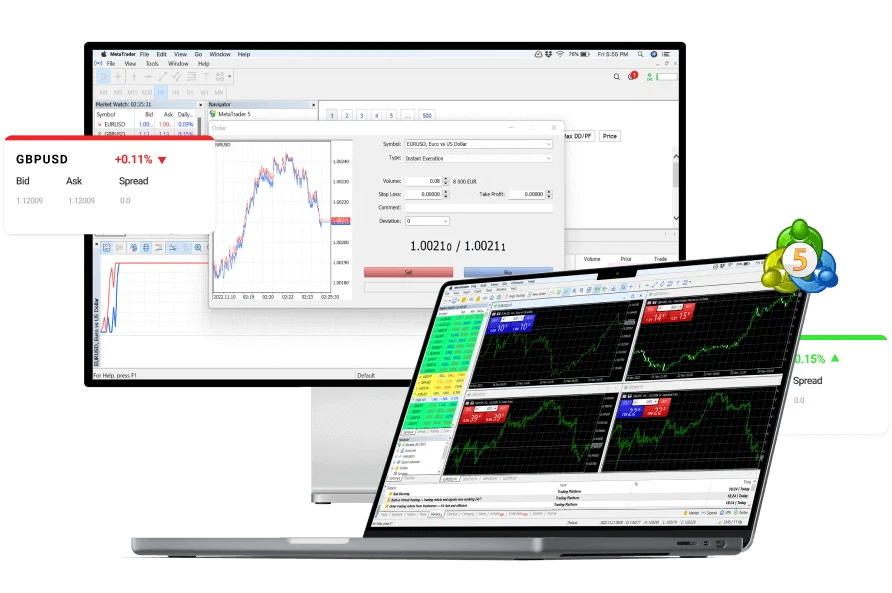

Follow professional traders and mirror their trades through Trading Platform.

Omega Finex is regulated and registered in two jurisdictions across the globe to ensure safety.

We provide more than 800 tradable assets on Omega Finex with best trading conditions.

Commodities are raw materials or primary agricultural products that can be bought and sold, such as gold, silver, oil, and agricultural products like wheat or corn. Certain currencies, especially those of countries that are major producers or consumers of these commodities, can be affected by changes in commodity prices.

How to trade commodities in Forex?

For example, if a country is a major exporter of oil, its currency may be influenced by changes in the price of oil. If the price of oil rises, it can positively impact the exporting country’s economy, and its currency may strengthen. Conversely, if the price of oil falls, it could have a negative impact on the economy and weaken the currency.

Traders who engage in commodities trading in the forex market analyze both currency and commodity markets to make informed trading decisions. They may use technical analysis, fundamental analysis, and other tools to predict price movements and take positions accordingly.

It’s important to note that while some currency pairs are influenced by commodities, not all of them are. The forex market is complex, and various factors, including economic indicators, geopolitical events, and interest rates, can also impact currency values. Traders should conduct thorough research and analysis before engaging in any form of trading.

Engaging in Metals trading offers the advantage of heightened liquidity, with the market boasting an impressive daily trading volume of $4 trillion. This substantial liquidity facilitates seamless entry and exit from trades, ensuring that participants can execute transactions with ease and efficiency, regardless of the time.

Metals trading provides an unparalleled level of flexibility by offering a diverse range of options suitable for various budgetary constraints. Traders can explore an extensive selection of currency pairs

The forex market stands out for its 24-hour availability, allowing traders to participate in the action every business day, regardless of their geographical location. This constant market activity ensures that opportunities are not confined to specific time zones, providing traders with the convenience of executing trades at any hour.

Forex trading presents the unique advantage of profit potential in both upward and downward market trends.