Forex trading, the practice of buying and selling currencies in the currency market, is a complex and highly strategic endeavor. One of the most important aspects that traders must understand includes basic and essential concepts such as slippage, spread, Forex pips, and lot in Forex, different types of technical indicators, and one other fundamental element: the Forex timeframe. The time frame in Forex is the backbone of any trading strategy, as it dictates how traders view market movements, interpret price action, and ultimately make trading decisions.

This article from the Omega Finex broker delves deeply into what this concept is, the different types of timeframes, and how to choose the best time frame in Forex for your specific trading style and goals.

What is a Forex Timeframe?

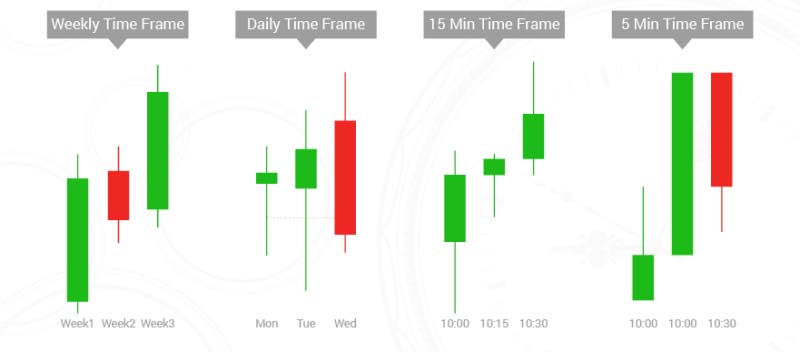

A time frame in Forex refers to the specific period represented by each candlestick, bar, or point on a chart. For example, in a 1-hour time frame, each candlestick represents trading activity during that hour. Different time frames are crucial for analyzing price movements, helping traders identify trends, reversals, and potential entry and exit points. They provide the temporal context in which price action is evaluated, enabling traders to make informed decisions based on historical data.

Importance

The time frame in Forex is essential because it allows traders to view the market through different lenses, whether through fundamental or technical analysis. By selecting different time frames, traders can analyze market behavior over short, medium, or long periods. This versatility is important because it offers multiple perspectives on price action, helping traders fine-tune their strategies and adapt to changing market conditions.

Additionally, Forex timeframe affects the type of trading strategy a trader might use. For instance, a scalper might use a 1-minute chart to capture quick movements, while a position trader might rely on a daily or weekly chart to capture long-term trends. Therefore, understanding these time frames is fundamental to creating a robust trading strategy that aligns with individual preferences and goals.

Types of Forex Timeframes

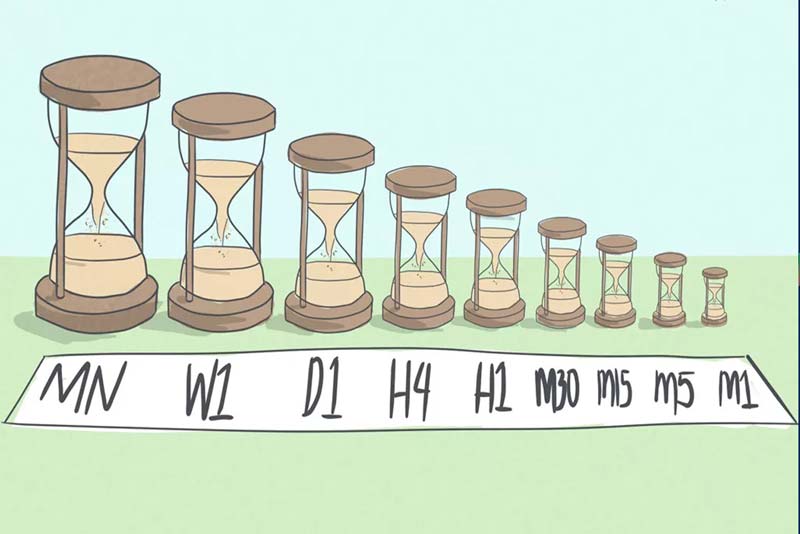

Forex traders can choose from a wide range of time frames, each offering a unique view of market activity. These time frames are typically grouped into three main categories: short-term, medium-term, and long-term.

Short-Term Time Frames

The short-term time frame in Forex include:

- M1 (1 minute)

- M5 (5 minutes)

- M15 (15 minutes)

\M30 (30 minutes)

Traders who prefer to capitalize on small price fluctuations within a short period tend to favor these time frames. These traders are often scalpers or day traders who aim to execute multiple trades within a single trading session. Short-term time frames provide detailed, minute-by-minute reports of market activity, which are crucial for making quick trading decisions.

Scalping in Short-Term Time Frames: Scalping is a trading strategy that involves making quick trades to capture small price changes. In this approach, traders rely heavily on 1-minute or 5-minute charts. The fast pace of these time frames requires precise timing and a strong understanding of technical views. Scalpers often use indicators such as moving averages, Bollinger Bands, stochastic oscillators, and RSI indicator to identify entry and exit points. The goal is to execute a high volume of trades and accumulate small profits, which can add up to significant returns over time.

Day Trading in Short-Term Time Frames: Day traders, who also operate in short-term time frame in Forex, differ from scalpers because they usually hold positions longer, from a few minutes to several hours, but always within the same day. Day traders may use 15-minute or 30-minute charts to find opportunities that align with the day’s trend. These traders seek more substantial price movements compared to scalpers and often use strategies like breakout trading, where they buy or sell when the price crosses a significant support or resistance level.

Medium-Term Time Frame in Forex

The medium-term time frame in Forex include:

- H1 (1 hour)

- H4 (4 hours)

Medium-term forex timeframe offers a balance between the detail of short-term charts and the broader perspective provided by long-term charts. These time frames are typically used by swing traders who aim to profit from price movements that occur over several hours to a few days.

Swing Trading in Medium-Term Time Frames: Swing trading involves holding positions for several days to capture price swings or trends that develop over time. Traders using H1 or H4 charts can identify these trends and enter trades at points where the market is likely to move in their favor.

Swing traders often use technical analysis tools like Fibonacci retracements, Moving Average Convergence Divergence (MACD), and RSI (Relative Strength Index) to identify potential market turning points. The 4-hour chart is particularly popular among swing traders as it provides a good balance of time and detail, allowing them to observe significant price changes without the noise that might occur in shorter forex time frames.

Long-Term Forex Timeframes

The long-term time frame in Forex include:

- D1 (1 day)

- W1 (1 week)

- MN (1 month)

Long-term time frame in Forex provide a broad view of the market, helping traders identify major trends that can last for weeks, months, or even years. These time frames are usually used by position traders and investors who have a longer-term outlook on the market.

Position Trading in Long-Term Time Frames: Position trading is a strategy where traders hold their positions for weeks, months, or even longer. This approach requires a deep understanding of fundamental analysis, as long-term market movements are often driven by macroeconomic factors such as interest rates, inflation, and geopolitical events.

Traders using daily, weekly, or monthly charts focus on major trends and often use indicators like moving averages, trend lines, and chart patterns (e.g., head and shoulders, double top) to make decisions. Patience is key in position trading, as it may take time for the market to move in the anticipated direction, but the potential profits can be substantial.

How to Choose the Best Time Frame in Forex for Trading?

Choosing the best time frame in forex is a crucial decision that can greatly impact your trading success. The “best” time frame largely depends on your trading style, goals, and personal circumstances. Here’s a deeper look at how different time frames align with various trading strategies:

Scalping

The best Time Frame in Forex: M1, M5

Strategy Features: Scalpers thrive on the volatility and speed of the forex market, often executing multiple trades within minutes. The 1-minute and 5-minute charts provide the necessary detail to observe and capitalize on small price movements. Scalping requires quick reflexes, a high tolerance for risk, and the ability to remain calm under pressure. Since scalpers operate in such short time frames, they often use high leverage to amplify their profits, though this also increases the risk of significant losses, making risk management techniques like stop-loss orders and position sizing essential.

Best Time Frame for Day Trading

Preferred Forex TimeFrame: M15, M30, H1

Strategy Features: Day traders aim to profit from intraday price movements without holding positions overnight. The 15-minute, 30-minute, and 1-hour time frame in forex are commonly used to identify trading opportunities that align with the daily trend. Day traders often focus on key economic events, such as interest rate announcements or employment reports, which can cause significant daily volatility. They may use a combination of indicators, like moving averages and volume analysis, to confirm entry and exit points. Since day traders close all positions by the end of the trading day, they avoid the risks associated with overnight market gaps.

Best Time Frame in Forex for Swing Trading

The best Time Frames: H4, D1

Strategy Features: Swing traders aim to capture medium-term price swings by holding positions for several days. The 4-hour and daily Forex timeframes provide a broader view of market trends, allowing swing traders to identify potential turning points and enter trades at favorable levels. Swing trading is well-suited for those who cannot monitor the markets continuously but still want to participate in forex trading. Traders often use a combination of technical and fundamental analysis to make decisions. For example, they might look for a combination of factors, like a key support level coinciding with a positive economic report, to justify entering a trade.

Position Trading

The best Time Frame in forex: D1, W1, MN

Strategy Features: Position traders focus on long-term trends and hold trades for extended periods, sometimes for months or even years. Daily, weekly, and monthly forex timeframes are ideal for this strategy, as they help traders identify major market trends and key support or resistance levels.

Position trading requires a deep understanding of macroeconomic factors and the willingness to endure short-term fluctuations in pursuit of long-term gains. Position traders are usually less concerned with short-term market noise and more focused on the bigger picture and time frame in forex. They may use a combination of technical and fundamental analysis, considering economic indicators, central bank policies, and geopolitical developments to inform their decisions.

Factors to Consider When Choosing the Best Time Frame in Forex

Choosing the best time frame in forex goes beyond just matching it with your trading style. Here are a few additional factors to keep in mind:

- Risk Tolerance: Shorter time frame in Forex usually involve higher risk due to increased market noise and rapid price changes. If you have a low tolerance for risk, you might prefer longer time frames, which tend to smooth out short-term fluctuations and provide clearer trend signals. On the other hand, if you thrive in high-risk, high-reward situations, shorter time frames might be more appealing.

- Trading Experience: Your experience level in forex trading can significantly influence your choice of the best time frame. New traders often find longer time frames easier to manage since they allow more time for market analysis and informed decision-making. Longer time frames also reduce the likelihood of making impulsive trades based on short-term market movements. Experienced traders, who are more familiar with market behavior and can quickly interpret forex indicators, may be drawn to shorter time frames for the increased opportunities they offer.

- Market Conditions: The forex market behaves differently depending on various factors, such as economic events, market sentiment, and global news. During a trending market, longer forex timeframes like daily or weekly charts may offer clearer signals for entering trades in the direction of the trend. Conversely, in a range-bound or sideways market, shorter time frames like 15-minute or 1-hour charts may present more opportunities for trading within a set range. Understanding the prevailing market conditions can help you choose the most suitable time frame for your strategy.

- Time Availability: The amount of time you can dedicate to trading each day should also influence your time frame choice. If you can only check the markets a few times a day, longer time frames like 4-hour or daily charts may be more suitable since they require less frequent monitoring. On the other hand, if you have the flexibility to watch the markets throughout the day, shorter time frame in Forex like 1-minute or 5-minute charts might be more appropriate, allowing you to capitalize on rapid price changes.

Conclusion

Forex Timeframes are a crucial aspect of forex trading, significantly affecting how traders analyze the market, make decisions, and ultimately succeed. The best time frame in forex is subjective and depends on your trading style, experience, risk tolerance, and time availability.

Whether you are a scalper aiming for quick profits in short time frames, a swing trader looking to capitalize on medium-term price movements, or a position trader with a long-term outlook, choosing the right time frame is essential. Multi-time frame analysis can enhance your trading strategy by providing a comprehensive view of the market, helping you avoid common pitfalls, and increasing your chances of success.

Ultimately, mastering the various time frames in forex requires practice, patience, and continuous learning. By experimenting with different time frames, refining your strategy, and maintaining discipline, you can find the approach that works best for you and achieve your trading goals.