The Fibonacci sequence is a mathematical concept that has found widespread use in various fields, including forex trading. In forex, Fibonacci trading is used as a tool for technical analysis and helps traders identify potential support and resistance levels, entry and exit points, and trend reversals. This guide from the OmegaFinex broker website covers the basics of this series, how to use Fibonacci in forex trading, and practical strategies for applying it.

What is the Fibonacci Sequence?

The Fibonacci sequence is a series of numbers in which each number is the sum of the two preceding ones, starting from 0 and 1. The sequence is as follows:

0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, …

The mathematical formula for generating the sequence is:

F(n) = F(n−1) + F(n−2)

where:

F(0) = 0

F(1) = 1

This sequence is important because it forms the Fibonacci ratios commonly used in trading.

Fibonacci in Forex

Fibonacci in forex are derived from the Fibo sequence and are used to predict future price movements. The most common ratios are:

- 61.8% (Golden Ratio): This is the most important Fibonacci ratio in forex and other phenomena, often called the “Golden Ratio,” obtained by dividing a number in the series by the next number (e.g., 55/89 ≈ 0.618).

- 38.2%: Found by dividing a number in the sequence by the number two places ahead (e.g., 55/144 ≈ 0.382).

- 23.6%: Obtained by dividing a number by the number three places ahead (e.g., 21/89 ≈ 0.236).

- 50%: Although not an actual Fibonacci ratio, the 50% level is widely used because prices naturally tend to retrace around halfway of the previous move.

These ratios are applied to price charts to identify potential areas where price changes or continuations may occur.

Key Fibonacci Tools in Forex

Fibonacci in forex can be applied using several tools, each serving a specific purpose:

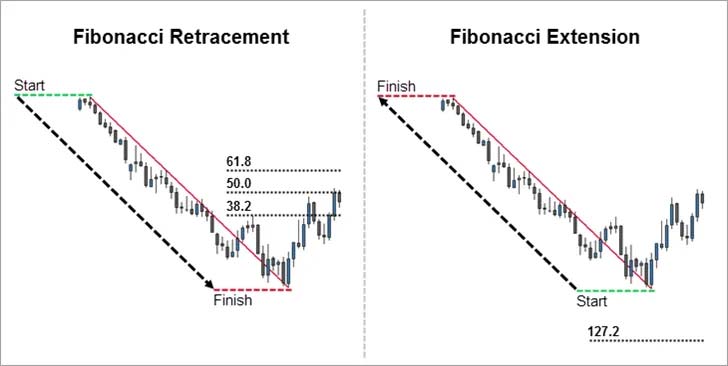

Fibonacci Retracement: The Fibonacci Retracement tool is the most common tool for Fibonacci trading. It helps identify potential reversal levels by drawing lines at key Fibonacci ratios between significant highs and lows on the price chart.

Traders draw Fibonacci retracement levels from the low to the high of the price movement in an uptrend and from the high to the low in a downtrend. The horizontal lines at 23.6%, 38.2%, 50%, 61.8%, and 78.6% act as potential levels where a price pullback might stop, indicating a return in the trend direction.

Fibonacci Extension: Fibonacci Extension is used to predict potential price targets during a continuing trend. These extensions go beyond the 100% level, helping traders anticipate the possible extent of a move.

Extension levels like 161.8%, 261.8%, and 423.6% are commonly used to use fibonacci in forex set profit targets after a correction ends, predicting how far the price could move in the direction of the trend.

Fibonacci Fan: These tools are less common in Fibonacci trading but can offer additional insights:

- Fibonacci Arcs: Curved lines drawn based on Fibonacci retracement levels provide visual cues for dynamic support and resistance.

- Fibonacci Fans: Diagonal lines drawn from highs to lows indicate possible trend lines based on Fibonacci levels.

- Fibonacci Time Zones: Vertical lines based on sequence numbers predict potential time zones using Fibonacci in Forex where significant price action may occur.

Step by Step Guid to Fibonacci trading

Here is a step-by-step guide on how to use Fibonacci in forex and extension levels in trading:

- Identify the Trend: Before applying Fibonacci in Forex, determine whether the market is in an uptrend or downtrend. Fibonacci retracement works better in trending markets.

- Select Swing High and Swing Low: In an uptrend, select the swing low and drag the retracement tool to the swing high. In a downtrend, select a swing high and drag the tool to the swing low.

- Apply Fibonacci Levels: Draw the Fibonacci retracement levels using the selected high and low points. Key levels (23.6%, 38.2%, 50%, 61.8%) will automatically appear on your chart.

- Analyze Price Action: Analyze the price action around Fibonacci levels and observe how prices interact with these levels. Key strategies include:

Enter at Reversal Levels: Using Fibonacci trading look for buying opportunities near 38.2%, 50%, or 61.8% in an uptrend or selling opportunities in a downtrend.

Place Stop Loss: For risk management, place stop-loss orders just beyond the next retracement level.

Set Profit Targets: Use Fibonacci in forex (e.g., 161.8%) to set profit levels.

Practical Strategies Using Fibonacci in Forex

In the world of forex, there are countless ways to analyze the market, from fundamental analysis, technical analysis, and using various technical indicators like the MACD and RSI, to other types. Let’s explore practical strategies for using Fibonacci in forex and trading.

Combining Fibonacci trading with Support and Resistance Levels

Fibonacci retracement levels often align with support and resistance zones, reinforcing the significance of these levels.

Strategy: When Fibonacci levels match support or resistance areas, they become stronger levels to monitor for potential trading setups.

Using Fibonacci with Other Indicators

Combining Fibonacci in forex with other indicators such as moving averages, RSI (Relative Strength Index), or MACD (Moving Average Convergence Divergence) can increase the reliability of trading signals.

Strategy: For example, if the price retraces to a Fibonacci level that aligns with a moving average, it may indicate a high-probability entry point.

Fibonacci Confluence Zones in Forex

When multiple Fibonacci levels cluster in a small area, they form a confluence zone—a highly significant level where the price may react strongly.

Strategy: Confluence zones are powerful and can act as key points for entry or exit.

Limitations of Trading with Fibonacci in Forex

While Fibonacci tools are popular in forex, they have limitations:

Not Standalone: Fibonacci in Forex should not be used in isolation. They are more effective when combined with other analysis tools.

False Signals: Prices do not always respect these levels. Traders should use other forms of confirmation.

Subjectivity: The accuracy of Fibonacci trading depends on selecting the correct swing highs and lows, which can be subjective.

Conclusion

Fibonacci in forex is a powerful tool for identifying potential market turning points. By understanding Fibonacci retracement and extension levels, traders can predict support and resistance areas, set strategic entry and exit points, and enhance their overall trading strategy. While Fibonacci trading should be used alongside other analysis methods, its versatility and ease of use make it a valuable tool for any trader.