Metals Trading

Embarking on precious metals trading begins with the setup of an account with a reputable broker. Once your account is established, deposit the desired trading capital. The broker furnishes you with a unique username and password, offering access to the dedicated trading platform or software. Armed with these credentials, you can seamlessly execute buy or sell orders, complete trades, and partake in various trading activities.

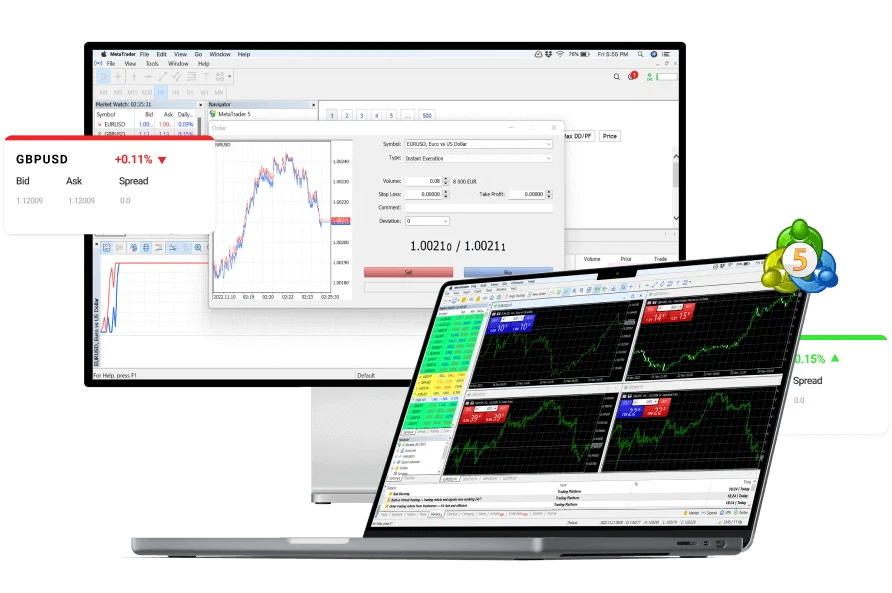

Follow professional traders and mirror their trades through Trading Platform.

Omega Finex is regulated and registered in two jurisdictions across the globe to ensure safety.

We provide more than 800 tradable assets on Omega Finex with best trading conditions.

The landscape of precious metals trading has evolved beyond traditional norms in recent years. In addition to the timeless allure of gold and silver, traders can now explore a spectrum of precious metals, including platinum, palladium, and others. Technological advancements have played a pivotal role in this expansion, providing traders with the tools to diversify their portfolios and strategically manage risk. Discover the opportunities that await as you navigate the world of precious metals trading, leveraging the benefits of a broader and more dynamic market.

What is the purpose of Metals Trading?

The purpose of metals trading is multifaceted and encompasses a range of economic, investment, and industrial objectives. Here are several key purposes of engaging in metals trading:

Hedging Against Price Volatility: Metals trading serves as a risk management strategy for various industries. Businesses, especially those involved in manufacturing and construction, use metals futures and options contracts to hedge against price volatility. By locking in prices for metals in advance, companies can mitigate the impact of unpredictable market fluctuations on their production costs.

Investment Diversification: For investors, metals trading offers a means of diversifying their investment portfolios. Precious metals like gold and silver, in particular, are often considered safe-haven assets, providing a hedge against inflation and economic uncertainty. Including metals in an investment portfolio can help spread risk and enhance overall portfolio stability.

Speculation and Profit Generation: Traders engage in metals trading to capitalize on price movements and generate profits. Whether trading precious metals or base metals, market participants analyze market trends, economic indicators, and geopolitical events to make informed trading decisions. The potential for profit attracts both individual and institutional traders to the metals market.

Supply Chain Management: Companies involved in metal-related industries, such as manufacturing and electronics, participate in metals trading to manage their supply chains effectively. Securing a stable supply of metals at predictable prices is crucial for maintaining consistent production and meeting customer demand.

Global Trade and Commerce: Metals trading is an integral part of the global economy, facilitating international trade. Metals are essential raw materials in various industries, and the ability to buy and sell them on the commodities market ensures a fluid and efficient global supply chain.

Price Discovery: The metals market plays a significant role in price discovery. The interaction of supply and demand dynamics in metals trading helps establish fair market prices. These prices, in turn, influence contract negotiations, trade agreements, and the valuation of related financial instruments.

Engaging in Metals trading offers the advantage of heightened liquidity, with the market boasting an impressive daily trading volume of $4 trillion. This substantial liquidity facilitates seamless entry and exit from trades, ensuring that participants can execute transactions with ease and efficiency, regardless of the time.

Metals trading provides an unparalleled level of flexibility by offering a diverse range of options suitable for various budgetary constraints. Traders can explore an extensive selection of currency pairs

The forex market stands out for its 24-hour availability, allowing traders to participate in the action every business day, regardless of their geographical location. This constant market activity ensures that opportunities are not confined to specific time zones, providing traders with the convenience of executing trades at any hour.

Forex trading presents the unique advantage of profit potential in both upward and downward market trends.

In summary, metals trading serves as a vital component of the global economy, offering risk management solutions, investment opportunities, and contributing to the efficient functioning of industries dependent on metal commodities. Whether for hedging, investment, speculation, or supply chain management, participants in metals trading contribute to the liquidity and stability of the broader financial markets.