What is a Lot in Forex? Forex Lot Calculating

One of the fundamental concepts in forex trading is the “forex lot.” Understanding what a lot in forex is, how it works, and its importance is crucial for anyone looking to invest in this market with even minimum balance for forex trading. The aim of this article from the OmegaFinex Broker is to provide a deep understanding of the lot in forex trading, including its types, how to calculate it, and its impact on trading strategies.

What is a Lot in Forex?

A lot in forex represents a standard unit of measurement for the size of a trade. It indicates the amount of currency being traded. Unlike stocks, where you buy and sell a specific number of shares, forex trades are conducted with currency pairs, and the lot size determines the trade volume.

A forex lot is a predetermined amount of currency that traders buy or sell. For example, if you trade the EUR/USD pair, the lot size determines how many euros you are buying or selling against the US dollar. The concept of a lot helps standardize trade volumes and allows for easier comparison and calculation of trade size, profits, and losses.

Types of Forex Lots

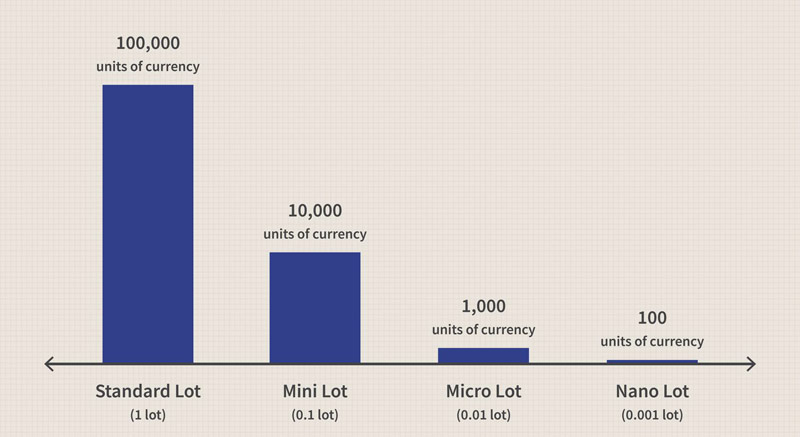

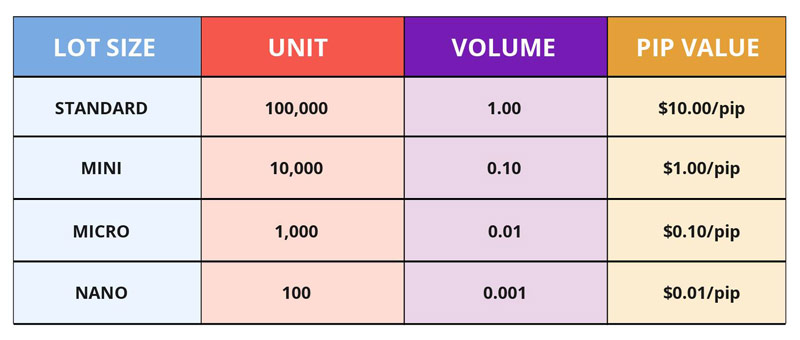

There are four main types of forex lots: standard lots, mini lots, micro lots, and nano lots. Each type represents a different amount of currency units. Let’s review each of these types:

Standard Lot

A standard lot is the largest lot size in forex, equivalent to 100,000 units of the base currency. For example, if you trade the EUR/USD pair, one standard lot would be 100,000 euros. Standard lots are typically used by institutional traders or those with substantial capital.

- Example: If you buy 1 standard lot of the EUR/USD pair at an exchange rate of 1.2000, you are buying 100,000 euros, which would cost 120,000 US dollars.

- Advantages: Standard forex lots allow for larger trades and potentially higher profits. They are suitable for experienced traders and those with significant capital.

- Risk: Larger trade sizes also mean higher potential losses. Traders must manage risk effectively when trading standard lots.

Mini Lot in Forex

A mini lot in forex is one-tenth the size of a standard lot, equaling 10,000 units of the base currency. This lot size is more accessible for individual traders who may not have the capital to trade standard lots. For example, in the EUR/USD pair, one mini lot would be 10,000 euros.

- Example: If you buy 1 mini lot of the EUR/USD pair at an exchange rate of 1.2000, you are buying 10,000 euros, which would cost 12,000 US dollars.

- Advantages: Mini forex lots create a balance between trade size and risk, making them suitable for many retail traders.

- Risk: While the risk is lower than standard lots, traders should still manage their positions carefully to avoid significant losses.

Micro Lots

A micro forex lot is one-hundredth of a standard lot, equaling 1,000 units of the base currency. Micro lots are ideal for beginners or those looking to trade smaller amounts. In the EUR/USD pair, one micro lot would be 1,000 euros.

- Example: If you buy 1 micro lot of the EUR/USD pair at an exchange rate of 1.2000, you are buying 1,000 euros, which would cost 1,200 US dollars.

- Advantages: Micro forex lots allow for smaller trades and lower risk, making them great for beginners or those with limited capital.

- Risk: Smaller trade sizes limit potential profits but also minimize potential losses, providing a safer trading environment for new traders.

Nano Forex Lot

A nano lot is the smallest lot size in forex, representing 100 units of the base currency. This lot size is rarely offered by brokers, but it can be useful for traders who want to minimize their risk. In the EUR/USD pair, a nano lot would be 100 euros.

- Example: If you buy 1 nano lot of the EUR/USD pair at an exchange rate of 1.2000, you are buying 100 euros, which would cost 120 US dollars.

- Advantages: Nano lots are excellent for testing trading strategies and learning without risking significant capital.

- Risk: The minimal trade size means very limited profit potential, but also ensures very low risk.

How to Calculate Forex Lot Size

Calculating lot size in forex is crucial for risk management and ensuring that your trades align with your trading strategy. Here are the steps to calculate lot size:

- Determine Your Risk Tolerance: Decide how much of your capital you are willing to risk on a single trade. A common rule of thumb is not to risk more than 1 to 2% of your account on a single trade. This helps ensure that you don’t deplete your trading capital quickly if a trade goes against you. Example: If you have a trading account with $10,000 and decide to risk 1% per trade, you will risk $100 on each trade.

- Identify the Stop Loss Level: Set a stop loss level, which is the price at which you will exit the trade to prevent further losses. This level should be based on your analysis and trading strategy. The stop loss helps limit your losses if the market moves against your position. Example: If you buy the EUR/USD pair at 1.2000 and set the stop loss at 1.1950, you are risking 50 pips on the trade.

- Calculate the Pip Value: The pip value is the monetary value of a one-pip movement in the currency pair. It varies depending on the currency pair and the lot size. For most currency pairs with the US dollar as the quote currency, the pip value is $10 for a standard lot, $1 for a mini lot, and $0.10 for a micro lot. Example: For the EUR/USD pair, the pip value for a mini lot is $1.

- Determine the Forex Lot Size: Use the following formula to calculate the lot size:

Example: If you are risking $100 on a trade with a stop loss of 50 pips and a pip value of $1 (for a mini lot), the lot size will be:

This calculation ensures that your trade size aligns with your risk tolerance and stop-loss level.

The Impact of Lot size in Forex

The size of a forex lot has a significant impact on various aspects of trading, including risk management, leverage, and trading psychology.

Risk Management: Effective risk management requires proper lot sizing. Trading larger sizes increases potential profits but also increases potential losses. By using smaller lot sizes, traders can control their risk exposure and avoid significant losses.

Example: A trader with a $10,000 account who risks 1% per trade can trade 1 mini lot per trade, ensuring that a 50-pip loss results in a manageable $50 loss.

Leverage: Leverage allows traders to control larger positions with a smaller amount of capital, but it also increases risk. Understanding forex lot size helps traders use leverage more effectively and avoid overexposure to the market.

Example: With 100:1 leverage, a trader can control a standard lot ($100,000) with just $1,000 of capital. While this amplifies potential profits, it also means losses can quickly exceed the trader’s capital if not properly managed.

Trading Psychology: The psychology of trading plays an important role in successful trading. Using appropriate trade sizes can help manage emotions like fear and greed. Trading with large sizes can lead to emotional decisions, while trading with smaller lot sizes encourages discipline and logical decision-making.

Example: A trader using micro lots in forex can make more calculated decisions without the stress of significant potential losses, leading to better adherence to trading strategies and improved long-term performance.

Summary of Forex Lot Size Education

Understanding lot sizes in forex is essential for anyone looking to succeed in the market. By knowing the different types of lots, how to calculate them, and their impact on trades, traders can make informed decisions and develop effective trading strategies.

Whether you are a beginner or an experienced trader, mastering the concept of lot sizes will enhance your trading skills and improve your overall performance in the forex market. Proper management of forex lot sizes ensures that traders can control risk, use leverage effectively, and maintain balanced trading psychology, all of which are crucial components of successful forex trading.