What is Swap in Forex? 0 to 100 about Swap in Forex

Swap in forex, also known as “rollover,” is a lesser-known but important concept that can significantly impact your trading strategy, especially if you hold positions overnight. This article from OmegaFinex broker delves into what forex swap is, how it works, the factors that affect it, and its importance in forex trading. By the end of this guide, you’ll have a solid understanding of rollovers and how to manage them effectively.

What is Swap in Forex?

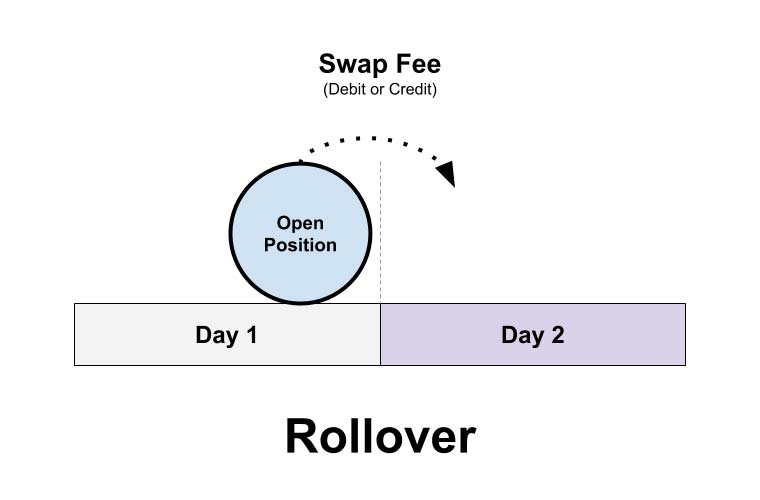

Forex swap refers to the interest you either earn or pay for holding a position overnight. In forex trading, you borrow one currency to buy another, and this process involves interest costs, which are represented by the swap in forex. This rate is determined by the difference in interest rates between the two currencies in the pair you are trading.

How Does Forex Swap Work?

When you hold a forex position overnight, you essentially borrow one currency to buy another. For example, if you trade the EUR/USD pair and buy euros while selling dollars, you are borrowing US dollars to buy euros. Depending on the interest rates of the respective currencies, you will either earn interest or pay it.

Positive Swap: If the interest rate of the currency you buy is higher than that of the currency you sell, you will receive a positive swap. This means you’ll earn interest for holding the position overnight.

Negative Swap: Conversely, if the interest rate of the currency you buy is lower than that of the currency you sell, you will incur a negative swap. This means you’ll have to pay interest to maintain the position overnight.

Factors Affecting Forex Swap Rates

Several factors influence the forex swap rate:

- Interest Rate Differentials: The primary factor affecting the swap rate is the difference in interest rates between the two currencies in the pair. Central banks set these rates, and they can fluctuate based on economic conditions.

- Broker Markup: Some brokers add a markup to the forex swap rate, which can increase the cost of holding a position overnight. It’s essential to understand your broker’s policy on swap rates.

- Market Conditions: Economic events, geopolitical developments, and shifts in market sentiment can also impact this rate. For example, during periods of economic instability, central banks may adjust interest rates, leading to changes in swap rates.

- Day of the Week: Forex swap rates are usually tripled on Wednesdays to account for the weekend since forex markets are closed on Saturdays and Sundays. This is known as the “triple swap.”

How to Calculate Swap

Calculating the swap rate in forex is essential for traders who hold positions overnight. While brokers often display swap rates on their trading platforms, understanding how to calculate them can help you plan your trading strategy. The basic formula for calculating swap in forex is:

- Pip Value: The value of one pip in the currency you are trading.

- Swap Rate: The difference in interest rates between the two currencies in the pair.

- Number of Nights Held: The number of days you intend to hold the position.

For example, if you are trading EUR/USD with a swap rate of -0.5 pips and you hold the position for 5 days, the swap cost will be:

Importance of Forex Swap

Understanding and managing swap is crucial for several reasons:

Impact on Profitability: The swap rate can significantly affect the profitability of your trades, especially for long-term positions. A negative swap can eat into your profits, while a positive rate can enhance them.

Strategic Considerations: Traders using long-term strategies like swing trading or position trading should consider the forex swap rate when planning their trades. Ignoring swap could lead to unexpected costs.

Carry Trade Strategy: This strategy involves borrowing a currency with a low-interest rate and using it to buy a currency with a higher interest rate, aiming to profit from the interest rate difference. The swap rate is a key part of this strategy.

Risk Management: The swap rate can also impact your risk management. High swap in Forex costs can increase your overall risk, especially if market conditions change unexpectedly.

Managing Swap

To manage swap effectively in Forex, consider the following tips:

- Choose Your Pairs Wisely: If you plan to hold positions overnight, select currency pairs with favorable interest rate differentials. Avoid pairs with high negative swap unless your strategy justifies it.

- Monitor Swap Rates Regularly: Swap rates can change frequently due to market conditions. Regularly check the rates provided by your broker to stay informed.

- Use a Swap-Free Account: Some brokers offer swap-free accounts, also known as Islamic accounts, which do not charge or pay swap. These accounts are designed for traders who cannot earn or pay interest for religious reasons.

- Incorporate Swap into Your Strategy: Factor in the swap costs when planning your trades. For example, if you are swing trading, ensure that the potential profit outweighs the swap costs.

Summary

Swap in forex is a crucial concept that every trader should understand, especially if you hold positions overnight. The forex swap rate, influenced by interest rate differentials, broker policies, and market conditions, can impact your overall profitability. By understanding how it works and incorporating it into your trading strategy, you can make informed decisions that enhance your trading performance.

Whether you’re a short-term trader or a long-term investor, being aware of forex swap rates and managing them effectively can help you avoid unexpected costs and maximize your returns in the forex market.