What is Cryptocurrency? A Complete Guide to Crypto

Cryptocurrency has changed the way we think about money, transactions, and finance. Since the creation of Bitcoin in 2009, the world of crypto has grown rapidly, becoming a multi-trillion-dollar market with thousands of currencies available today. This article from OmegaFinex provides an overview of what is cryptocurrency, covering its origin, mechanics, benefits, risks, and impact on various industries.

What is Cryptocurrency?

Cryptocurrency is a type of digital or virtual money that relies on cryptography for security. Unlike traditional currencies issued by governments, these currencies are decentralized and operate on blockchain technology, eliminating the need for a central authority like a bank or government to verify transactions. The decentralized nature of crypto means that no single entity controls it, and transactions are peer-to-peer, verified by a network of computers (nodes) around the world.

The term “cryptocurrency” combines two words: “crypto,” meaning cryptography (the art of writing or solving codes), and “currency,” meaning a system of money. Cryptography ensures that transactions are secure, and the creation of new currency units follows strict rules, making it nearly impossible to manipulate or counterfeit cryptocurrencies.

The Birth of Bitcoin and the Rise of Cryptocurrency

Bitcoin, the first and most well-known cryptocurrency, was created in 2009 by an anonymous individual or group under the pseudonym Satoshi Nakamoto. Nakamoto’s goal was to create a decentralized currency that would allow people to send payments directly to each other without needing intermediaries like banks.

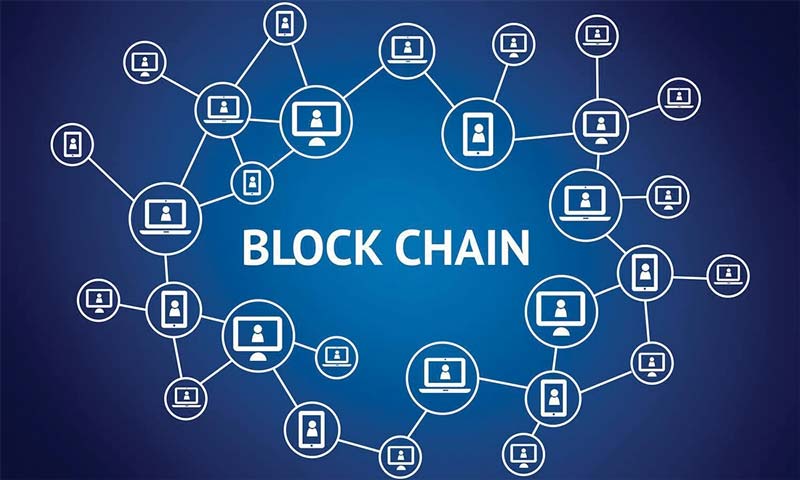

Bitcoin introduced blockchain technology, a distributed ledger system that records all transactions transparently and immutably. Each transaction is recorded in a “block,” which is then added to a “chain” of previous transactions, creating a permanent and verifiable history. Bitcoin’s decentralized nature means that no single entity controls the network, and users can send payments to anyone, anywhere in the world, at any time.

Following Bitcoin’s success, thousands of other cryptocurrencies have been created, each with its own unique features and use cases. Some of the most popular cryptocurrencies include:

- Ethereum (ETH): A blockchain platform that allows developers to create decentralized applications (DApps) and smart contracts.

- Ripple (XRP): A digital payment protocol designed to enable fast and low-cost international money transfers.

- Litecoin (LTC): Often called the “silver to Bitcoin’s gold,” Litecoin offers faster transaction times and a different mining algorithm.

- Cardano (ADA): A blockchain platform focused on security, scalability, and sustainability.

These are just a few examples of the thousands of cryptocurrencies that have emerged over the past decade, each aiming to solve different problems or improve existing technologies. In addition to trading various forex currency pairs, indices, commodities, precious metals trading, and stocks, these coins are also used to diversify traders’ portfolios in the Forex trading and cryptocurrency trading.

How Does Crypto Work?

To understand the world of cryptocurrencies, it’s essential to grasp the fundamental technology behind them: blockchain. Blockchain is a decentralized ledger that records all transactions made with a specific cryptocurrency. Each transaction is verified by a network of computers (miners or validators) and added to the blockchain, ensuring the accuracy and security of the ledger. Here is a simple breakdown of how crypto transactions work:

- Transaction Initiation: When a user wants to send cryptocurrency to another user, a transaction request is created, containing details such as the amount of currency being sent and the recipient’s wallet address.

- Verification and Consensus: The transaction is broadcast to the crypto network, where it must be verified by several nodes (computers) to ensure that the sender has enough funds and the transaction is legitimate.

- Block Creation: Once verified, the transaction is grouped with other transactions into a block. This block is then added to the existing chain of blocks (blockchain), forming a permanent and unchangeable record.

- Rewards for Miners/Validators: In some cryptocurrency networks, participants who verify transactions (miners or validators) are rewarded with newly created cryptocurrency or transaction fees as an incentive for maintaining the network.

- Transaction Completion: Once the transaction is added to the blockchain, it is considered complete, and the recipient can access the transferred funds.

What is Cryptocurrency’s Benefit

Cryptocurrencies offer several advantages over traditional forms of money and financial systems, contributing to their rapid adoption and growth. Lets see what is cryptocurrency benefit:

Decentralization: Cryptocurrency operates on decentralized networks, meaning no single entity controls the currency or transactions. This eliminates the need for intermediaries like banks, allowing users to have full control over their funds.

Security: Cryptography ensures that cryptocurrency transactions are secure and resistant to hacking. Each transaction is recorded on a blockchain, making it nearly impossible to alter or tamper with past transactions.

Transparency: The transparent nature of blockchain technology allows anyone to view the transaction history of a particular cryptocurrency. This fosters trust in the system and reduces the risk of fraud.

Lower Transaction Fees: Cryptocurrency transactions typically involve lower fees compared to traditional banking or payment systems, especially for international transfers. This makes them a cost-effective option for cross-border payments.

Financial Inclusion: Cryptocurrencies provide access to financial services for individuals who lack access to traditional banking systems, particularly in developing countries where banking infrastructure is limited.

Speed: Cryptocurrency transactions are processed much faster than traditional banking systems. In many cases, transactions can be completed within minutes, regardless of geographical location.

What Are the Risks?

Despite the numerous benefits, the world of crypto is not without risks. Investors and users must be aware of these risks before getting involved. Lets see what is cryptocurrency risk. Below are the main risks associated with crypto:

Volatility: Crypto coins are known for their price volatility. Bitcoin and other cryptocurrencies can experience significant price swings in a short period, leading to substantial gains or losses for investors.

Security Breaches: While blockchain technology is secure, cryptocurrency exchanges and wallets have been targets of hacking and theft. Users who do not take proper precautions to secure their private keys risk losing their funds.

Regulatory Uncertainty: The regulatory environment surrounding cryptocurrencies is still evolving, with governments around the world developing different approaches to cryptocurrency regulation. In some countries, cryptocurrencies are banned, while others have implemented strict regulations. This uncertainty can affect their value and legality.

Lack of Consumer Protection: Unlike traditional banking systems, crypto transactions are irreversible. If a user sends funds to the wrong address or falls victim to fraud, there is no way to recover the lost funds.

Limited Adoption: While the acceptance of cryptocurrency is growing, it is still relatively limited compared to traditional financial systems. Not all places accept digital currencies as payment, and converting digital assets into fiat currency can be challenging in certain regions.

Understanding both the advantages and risks of cryptocurrencies is essential for making informed decisions when engaging in this rapidly growing market.

Cryptocurrencies as an Investment

Many people view cryptocurrency as an investment opportunity, similar to stocks, bonds, or other asset classes. While some investors see it as a store of value (like gold), others consider it a speculative asset with high potential returns. There are several ways to invest in this space, including:

Buy and Hold (HODLing): This strategy involves buying cryptocurrency and holding it for a long period, expecting its value to increase over time. For example, Bitcoin has seen significant price growth since its inception.

Trading: Active traders frequently buy and sell cryptocurrencies to profit from price fluctuations. This strategy requires a deep understanding of the market and technical analysis skills.

Staking: Some cryptocurrencies, like Ethereum 2.0 and Cardano, allow users to “stake” their coins by locking them up to help validate network transactions. In return, stakers receive rewards in the form of additional currency.

Initial Coin Offering (ICO): In the early stages of cryptocurrency development, ICOs were a popular way for new projects to raise capital. Investors could purchase new tokens at a lower price, hoping for future price appreciation.

The Future of Cryptocurrency

What is Cryptocurrency future? What does the future hold for crypto? It’s full of potential and possibilities. As technology advances, cryptocurrencies are likely to integrate into mainstream financial systems. The adoption of decentralized finance (DeFi) and non-fungible tokens (NFTs) is already starting to reshape industries beyond finance, including art, gaming, and entertainment.

Moreover, governments and central banks are exploring the idea of creating central bank digital currencies (CBDCs), combining the benefits of crypto with the stability of traditional currencies. As the regulatory landscape becomes clearer, institutional investors are also expected to play a more significant role in the crypto market.

Conclusion

The world of crypto is dynamic, rapidly evolving, and filled with opportunities for those who understand its mechanisms and risks. While it offers numerous benefits such as decentralization, transparency, and financial inclusion, it also brings challenges related to volatility, security, and regulation. Whether you are an investor, trader, or simply interested in the technology behind cryptocurrency, it’s crucial to stay informed and approach this space with caution and curiosity.

Crypto is more than just an alternative form of money. It’s a transformative technology with the potential to change how we conduct transactions, store value, and interact with financial systems globally. As the world of cryptocurrency continues to evolve, its impact on our daily lives will become increasingly significant.