Fundamental analysis in forex is a crucial method used by forex traders to evaluate the value of currencies and in forex trading. This approach involves analyzing economic, social, and political forces that can affect currency prices. Unlike technical analysis, which focuses on charts and price patterns, fundamental analysis examines the underlying factors that influence the market. Below is a comprehensive guide from OmegaFinex Broker to this method of analysis in forex.

Basics of Fundamental Analysis in Forex

Fundamental analysis in forex involves evaluating a country’s economic fundamentals to determine the likely direction of its currency. This method requires understanding various economic indicators, interest rates, political stability, and overall economic performance.

The goal is to identify trends and patterns that may not be immediately visible on price charts but are crucial in shaping future price movements of forex currency pairs. Key components of fundamental analysis include:

Economic Indicators: Economic indicators are statistics that provide information about a country’s economic performance. Some of the most important indicators for forex traders include:

- Gross Domestic Product (GDP): GDP measures the total economic output of a country. GDP growth is a sign of a strong economy, which can strengthen the country’s currency.

- Employment Data: Employment reports, including the Non-Farm Payrolls in the U.S., offer insights into the health of the labor market. High employment rates typically indicate a strong economy.

- Inflation Rate: Inflation measures the rate at which prices for goods and services increase. Central banks often target a specific inflation rate to maintain price stability. High inflation can reduce purchasing power and weaken a currency.

- Retail Sales: Retail sales data reflect consumer spending, a key component of economic activity. Increasing retail sales indicate a healthy economy.

- Industrial Production: This measures the output of factories and mines. An increase in industrial production can signal economic growth.

Interest Rates: Central banks, like the Federal Reserve in the U.S., set interest rates to control monetary policy. Interest rates have a direct impact on currency value and are the most important factor in fundamental analysis in forex. Higher interest rates offer better returns on investments made in that currency, attracting foreign capital and increasing the currency’s value. Conversely, lowering interest rates can lead to a decrease in currency value.

Political Stability: Political events and stability are crucial in fundamental analysis for forex. Political instability or changes in government can lead to uncertainty, affect investor confidence, and cause currency volatility. Elections, policy changes, geopolitical tensions, and other political events can have immediate and long-term effects on currency prices.

Political Stability: Political events and stability are crucial in fundamental analysis for forex. Political instability or changes in government can lead to uncertainty, affect investor confidence, and cause currency volatility. Elections, policy changes, geopolitical tensions, and other political events can have immediate and long-term effects on currency prices.

Trade Balance: The trade balance, which measures the difference between a country’s exports and imports, also impacts currency value. A trade surplus (more exports than imports) usually strengthens a currency, while a trade deficit (more imports than exports) can weaken it.

Public Debt: High levels of public debt can lead to inflationary pressures and decrease the value of a currency. In forex fundamental analysis, countries with lower levels of debt are generally seen as more financially stable and support a stronger currency.

How to Conduct Fundamental Analysis in Forex

To effectively use fundamental analysis in forex, traders need to stay informed about economic news and events. This includes:

- Economic Calendars: Economic calendar list upcoming economic events and releases, such as GDP reports, employment data, and central bank meetings. Traders use these calendars to anticipate market movements and make informed decisions.

- News Sources: Keeping up with global news is essential for fundamental analysis in forex. Financial news agencies, government reports, and central bank announcements provide valuable information that can impact forex markets.

- Reports and Analysis: Reading and analyzing reports from financial institutions, central banks, and research firms helps traders understand the broader economic context. These reports often include forecasts and analyses that can guide trading strategies.

Practical Example of Fundamental Analysis in Forex

To illustrate how fundamental analysis works in forex, let’s consider a case study involving the U.S. dollar (USD) and the euro (EUR).

Economic Indicators: Suppose the U.S. reports higher-than-expected GDP growth, indicating a strong economy, while the Eurozone experiences lower GDP growth and rising unemployment. Based on this data, a trader might predict that the dollar will strengthen against the euro.

Interest Rates: The Federal Reserve announces an interest rate hike, while the European Central Bank (ECB) keeps rates unchanged. As mentioned earlier, higher U.S. interest rates make dollar-denominated assets more attractive, leading to increased demand for the dollar.

Political Stability: The Eurozone faces political uncertainty due to upcoming elections in major member countries, while the U.S. remains politically stable. This uncertainty in the Eurozone might weaken the euro as investors seek safer assets.

Trade Balance: The U.S. reports a reduced trade deficit, indicating stronger export performance, while the Eurozone struggles with a growing trade deficit. These trade data further support a stronger dollar in fundamental analysis.

Public Debt: Eurozone countries face rising levels of public debt, raising concerns about economic stability. In contrast, the U.S. maintains manageable debt levels. According to fundamental analysis, investors might prefer the dollar over the euro due to lower risk.

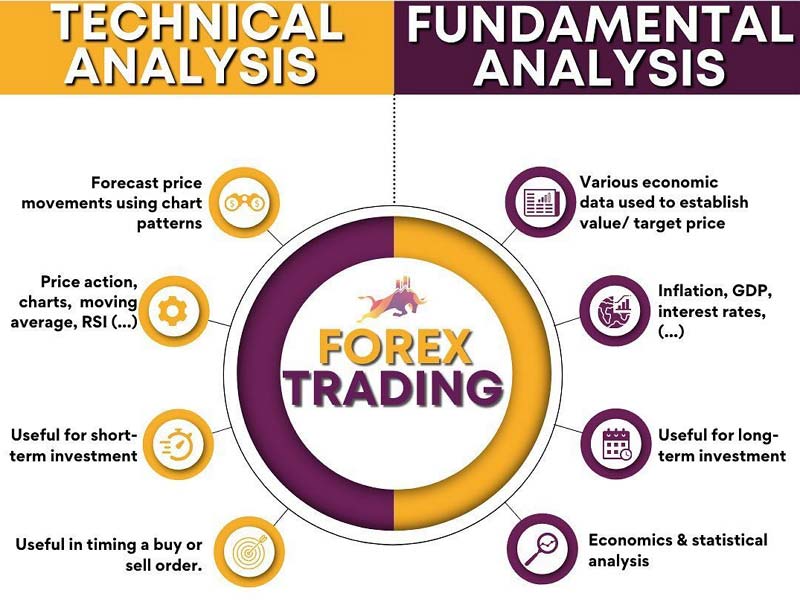

Integrating Fundamental and Technical Analysis

Many traders find it useful to combine fundamental and technical analysis. While fundamental analysis in forex provides a broader context and a long-term perspective, technical analysis offers precise entry and exit points based on price patterns and trends. By integrating both approaches, traders can develop stronger trading strategies.

For example, a trader might use fundamental analysis to identify a long-term trend in favor of a stronger dollar based on economic indicators and interest rate differentials. Then, they can use technical analysis to determine the best times to enter and exit trades within this broader trend.

Strengths and Limitations

Just as technical analysis and various technical indicators like the RSI indicator or MACD have their own advantages and weaknesses, fundamental analysis in forex also comes with its strengths and limitations. Let’s explore them below.

Strengths of Fundamental Analysis in Forex

- Deep Insights: Fundamental analysis in forex provides a comprehensive understanding of the factors driving currency value, offering a broader perspective compared to technical analysis alone.

- Long-Term Trends: By focusing on economic fundamentals, traders can identify long-term trends and make informed decisions about future currency movements.

- Risk Management: Understanding the economic context helps traders manage risks more effectively by anticipating potential market shifts and adjusting their strategies accordingly.

Limitations

- Complexity: Fundamental analysis in forex requires a deep understanding of economics and the ability to interpret a wide range of data. This complexity can be challenging for novice traders.

- Time-Consuming: Keeping up with news, reports, and economic events requires significant time and effort. Traders must be diligent in their research to stay informed.

- Delayed Reactions: Economic data releases in fundamental analysis can have delayed effects on currency prices. While fundamental factors may indicate a particular trend, market reactions might take time to materialize.

Conclusion

Fundamental analysis in forex is a powerful tool for forex traders, offering deep insights into the economic forces driving currency value. By analyzing economic indicators, interest rates, political stability, trade balances, and public debt, traders can make informed decisions about future currency movements.

While fundamental analysis in forex has its complexities and requires ongoing research, it provides valuable insights that can enhance trading strategies and risk management. By integrating fundamental analysis with technical analysis, traders can create a comprehensive approach to forex trading, increasing their chances of success in the dynamic and competitive forex market.