What is The Best Forex Broker? How To Find a Right Forex Broker

The popularity of forex trading has increased exponentially over the years due to its accessibility and profit potential in the global market with high liquidity. However, one of the most important steps a trader must take when entering the forex market is choosing the right forex broker.

The broker you choose can significantly impact your trading experience, from how trades are executed to the costs and risks you face. This forex tutorial from OmegaFinex reviews the features of the best forex broker and guides you in selecting one that fits your trading needs.

Why is choosing the right forex broker important?

The forex market is a decentralized market where traders and institutions trade currency pairs globally. A good forex broker acts as a mediator, facilitating trades between individual traders and the interbank market, where currency exchanges happen. The quality of the broker you choose can directly affect your trading success in several ways:

- Trade execution: The best forex broker is reliable and ensures your trades are executed quickly at the price you expect.

- Fees and costs: The spread and fees charged by brokers can significantly affect your profitability.

- Security: Regulated brokers provide protections that help secure your funds and reduce the risk of fraud or mismanagement.

- Tools and platforms: A good forex broker provides the trading platform and tools you need for technical analysis, charting, and managing trades, which influence the quality of your trading decisions.

The broker you choose should align with your trading goals, style, and risk tolerance. The best forex broker for one trader may not be the best for another. Let’s look at the key features that distinguish a broker.

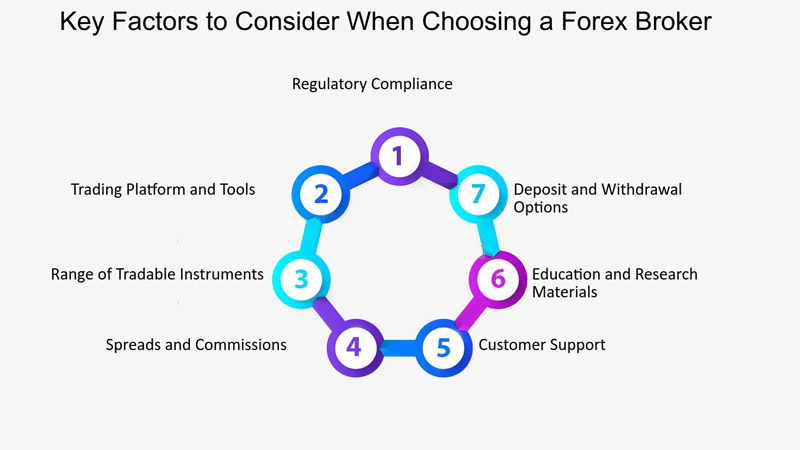

Key features of the best forex broker

When selecting the right broker, several essential features and factors need to be considered. These features help you determine if a broker is reliable, affordable, and suited to your specific trading needs.

Regulation and security

When choosing the right forex broker, security is the top concern. A good broker is regulated by a reputable financial authority, ensuring they operate according to industry standards. Regulatory bodies hold brokers accountable for maintaining transparent and fair trading practices, including client fund protection, fair pricing, and financial stability. Some well-known regulatory bodies include:

- Financial Conduct Authorities in the UK

- Securities Commissions in countries like Australia, Cyprus, and the United States

Regulated brokers are required to keep client funds in separate accounts, apart from the broker’s operational funds, ensuring your money is safe even if the broker faces financial difficulties. Always choose a well-regulated broker to protect your investment.

Leverage and margin with the best forex broker

Leverage allows traders to control larger trading positions with less capital. Brokers offer leverage to traders, enabling them to amplify potential profits (and losses). While high leverage can increase returns, it also comes with increased risk. When choosing the best forex broker, consider the leverage offered:

- Individual traders are often offered leverage from 1:30 to 1:50.

- Professional traders may have access to leverage up to 1:500 or more.

Leverage should be used carefully and in line with your risk tolerance. Look for a forex broker that offers flexible leverage options and margin requirements that suit your trading style.

Trading Platform

The trading platform provided by a broker is your main tool for interacting with the forex market. A good platform, like MetaTrader 4 or MetaTrader 5, is user-friendly and offers the features needed to execute trades and conduct analysis. When evaluating the platform of the best forex broker, look for the following features:

- Ease of use: The platform should be intuitive and easy to navigate, especially for beginners.

- Charting tools: A platform with advanced charting features, various forex indicators, and drawing tools allows you to conduct thorough technical analysis.

- Order types: The platform should offer multiple order types like market orders, limit orders, stop-loss, and trailing stop orders to effectively manage your trades.

- Execution speed: Fast order execution is crucial, especially in the rapidly moving forex market. Delays can lead to slippage, where the actual execution price differs from the expected price. Therefore, execution speed is another important factor when choosing the right forex broker.

- Mobile trading: Many traders prefer the flexibility of trading on mobile devices. Make sure the broker offers a mobile-friendly version of the platform for trading on the go.

The Importance of Spread and Commission When Choosing the Right Broker for Trading

Forex brokers make money from the difference between the buying (ask) and selling (bid) price of a currency pair, known as the spread. Some brokers also charge a commission per trade. When selecting a broker, pay attention to both the spread and the commission structure, as these are your primary trading costs.

- Spread: Lower spreads reduce your trading costs, which is especially important for day traders and scalpers who make many trades. Some brokers offer variable spreads that increase during volatile periods, while others offer fixed spreads. The best forex broker is one that offers lower costs.

- Commission: ECN (Electronic Communication Network) or STP (Straight-Through Processing) brokers often offer lower spreads but may charge a commission per trade. If you are a high-volume trader, low commissions along with tight spreads maximize your profitability.

Understanding the cost structure is critical. Transparent brokers and the best forex brokers clearly provide information about their spreads and commissions, ensuring there is no ambiguity about trading costs.

Order Execution and Slippage

The speed and quality of order execution are vital in forex trading, especially in volatile market conditions. The best forex broker should offer fast and efficient trade execution with minimal slippage.

- Slippage: This occurs when the price at which the trade is executed differs from the requested price, often due to delays or market volatility.

- Execution speed: Order execution should be as fast as possible, especially if you are trading with a strategy like scalping that relies heavily on making small, quick trades.

Look for a broker with a reputation for reliable execution speeds and minimal slippage, as this ensures that your trades are executed at the desired prices.

Account Types and Minimum Deposit in Forex Broker

Many brokers offer different trading accounts types to cater to a range of traders, from beginners to professionals. Common account types include:

Standard accounts: These typically offer average spreads and are suitable for beginner or casual traders.

ECN or STP accounts: These accounts offer tighter spreads but may charge a commission. They are ideal for more experienced traders looking for lower trading costs.

Mini accounts: These are ideal for beginners who want to start trading with a smaller investment. Some brokers even offer cent accounts, where you can trade very small forex lots.

Brokers may also have different minimum balance for forex trading requirements. Some allow you to open an account with as little as $50, while others may require a much larger deposit. Choose the best forex broker whose account types and minimum deposits align with your budget and goals.

Deposit and Withdrawal Methods with the Best Forex Broker

A reliable forex broker should offer a wide range of convenient and secure deposit and withdrawal methods. Common options include:

Bank transfers

Credit/debit cards

E-wallets (PayPal, Skrill, Neteller)

Cryptocurrencies (with specific brokers)

In addition to availability, the best forex broker should provide fast processing times with minimal or no fees for transactions. Avoid brokers with long withdrawal delays, as this can cause liquidity issues for traders.

Customer Support and Education

Access to quality customer support is essential, especially when you encounter technical or account-related issues. The best forex broker offers 24/7 customer service through multiple channels, such as:

Live chat

Phone support

Multilingual support can also be an advantage, especially if English is not your first language.

In addition to customer service, look for brokers that provide educational resources such as:

Webinars

Tutorials

Market analysis and insights

E-books

Educational tools are especially valuable for beginners, helping you increase your knowledge and improve your trading skills.

Demo Accounts with a Good Forex Broker

Many brokers offer demo accounts that allow traders to practice in real market conditions without risking real money. A demo account with a good broker is a great way to:

- Test the broker’s platform

- Evaluate the broker’s execution speed

- Try out trading strategies

It is always recommended to use a demo account to familiarize yourself with the broker’s platform and conditions before switching to a live account.

Reputation and Reviews in Choosing the Best Forex Broker

In today’s digital age, finding online reviews and feedback when choosing the best forex broker is easy. A reputable broker will have a positive reputation among its users and will be praised for transparency, customer support, and reliability. While no broker is perfect, a consistent pattern of negative reviews regarding issues like withdrawals, poor customer service, or unfair practices should be seen as a red flag.

Look for brokers with a proven track record and strong reviews, especially from traders who have used their services for a long time.

Conclusion

Choosing the right broker is a crucial decision that can significantly impact your trading success. By focusing on regulations, fees, platforms, customer service, and overall reliability, you can find the best forex broker that aligns with your trading style and goals.

Take your time to thoroughly research, use demo accounts, and ensure the broker provides the features and security you need. With the right broker, you’ll be well-equipped to navigate the forex market and increase your chances of success.